Bought By: 7160

Rating: 3.6

Get Good Marks in your MBA (MS) Financial Management Programme in the Term-End Exams even if you are busy in your job or profession.

We've sold over 39,626,346 Help Books and Delivered 48,231,430 Assignments Since 2002.

As our customers will tell you...yes, it really result-oriented.

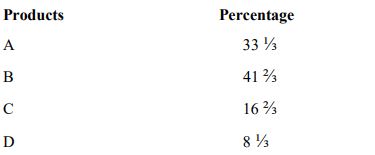

The total budgeted sales (100%) are Rs 6,00,000 per month. The operating costs for each product is :

60% of the Selling Price for product - A

68% of the Selling Price for product - B

80% of the Selling Price for product - C

40% of the Selling Price for product - D

The fixed costs are Rs. 1,59,000 per month.

(a) Calculate the Breakeven Point for the production on overall basis.

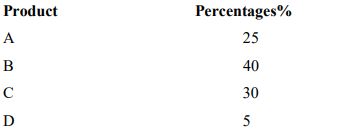

(b) If the sales mix is changed as follows and total sales per month remains at Rs. 6,00,000, calculate the new breakeven point.

The total budgeted sales (100%) are Rs 6,00,000 per month. The operating costs for each product is :

60% of the Selling Price for product - A

68% of the Selling Price for product - B

80% of the Selling Price for product - C

40% of the Selling Price for product - D

The fixed costs are Rs. 1,59,000 per month.

(a) Calculate the Breakeven Point for the production on overall basis.

(b) If the sales mix is changed as follows and total sales per month remains at Rs. 6,00,000, calculate the new breakeven point.

4. What do you understand by Leverage? Explain the concept of Financial and Operating Leverage. In what way is Financial Leverage related to Operating Leverage, discuss.

5. What is Capital Structure? Discuss the features of an appropriate Capital Structure and describe the determinants of Capital Structure.

4. What do you understand by Leverage? Explain the concept of Financial and Operating Leverage. In what way is Financial Leverage related to Operating Leverage, discuss.

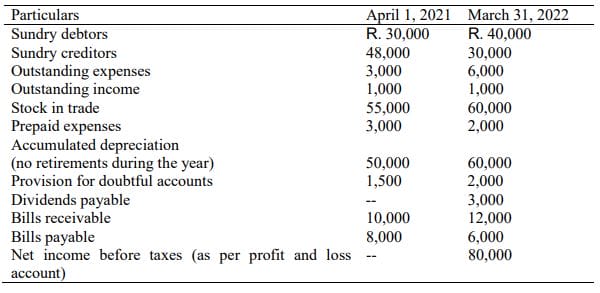

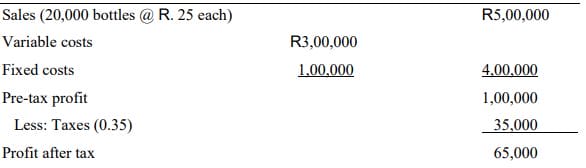

5. What is Capital Structure? Discuss the features of an appropriate Capital Structure and describe the determinants of Capital Structure. 3. The Colour Flow Ltd’s income statement for the preceding year is presented below. Except as noted, the cost/revenue relationship for the coming year is expected to follow the same pattern as in the preceding year. Income statement for the year ending March 31 is as follows:

3. The Colour Flow Ltd’s income statement for the preceding year is presented below. Except as noted, the cost/revenue relationship for the coming year is expected to follow the same pattern as in the preceding year. Income statement for the year ending March 31 is as follows:

1. What is the break-even point in amount and units?

2. Suppose that a plant expansion will add R 50,000 to fixed costs and increase capacity by 60 per cent. How many bottles would have to be sold after the addition to break-even?

3. At what level of sales will be company be able to maintain its present pre-tax profit position even after expansion?

4. The company’s management feels that is should earn at least R 10,000 (pre-tax per annum) on the new investment. What sales volume is required to enable the company to maintain existing profits and earn the minimum required return on new investments?

5. Suppose the plant operates at full capacity after the expansion, what profit after tax will be earned?

4. What are the various types of investment proposals? Explain the various discounted cash flow techniques used to evaluate investment proposals.

5. What is ‘Capital Structure’? Explain the features of an appropriate capital structure and discuss factors determining capital structure of a firm.

1. What is the break-even point in amount and units?

2. Suppose that a plant expansion will add R 50,000 to fixed costs and increase capacity by 60 per cent. How many bottles would have to be sold after the addition to break-even?

3. At what level of sales will be company be able to maintain its present pre-tax profit position even after expansion?

4. The company’s management feels that is should earn at least R 10,000 (pre-tax per annum) on the new investment. What sales volume is required to enable the company to maintain existing profits and earn the minimum required return on new investments?

5. Suppose the plant operates at full capacity after the expansion, what profit after tax will be earned?

4. What are the various types of investment proposals? Explain the various discounted cash flow techniques used to evaluate investment proposals.

5. What is ‘Capital Structure’? Explain the features of an appropriate capital structure and discuss factors determining capital structure of a firm.To attend IGNOU MS-04 Term-End Examination, you must first submit your Assignments to the university and it is possible from the MS-04 study material. You can solve all necessary Assignments using Help Books. This will help in gaining good marks.

All best wishes with our efforts that you do not meet any obstacle before attending examinations next year. You can pass the MBA (MS) Financial Management Programme Annual Exams with a good grade using Books/Materials from any one place at home or anywhere else!

ALL THE BEST!!!

Team GullyBaba