IGNOU BCOC-131 (July 2023 - June 2024) Assignment Questions

SECTION-A

Attempt all the questions. Each question carries 10 marks.

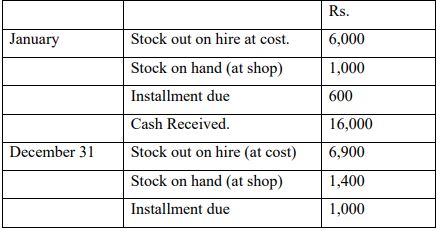

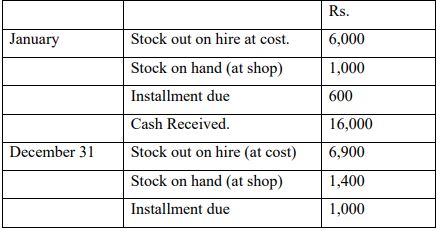

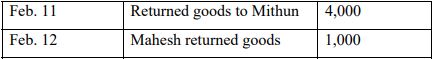

1. Home appliances Ltd. Sells goods on hire purchase terms at a profit of 25% on hire purchase price. Following are the transactions for the year ended December 31, 2018.

Calculate the profit or loss on hire purchase under Debtors Method.

2. What are the qualitative characteristics of accounting information? Briefly explain.

3. Explain the Concept of IFRS.

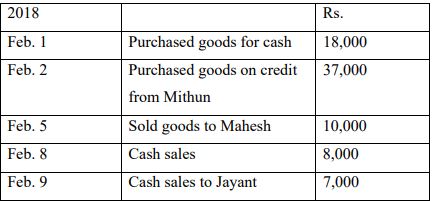

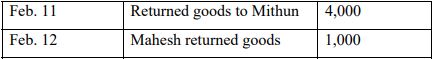

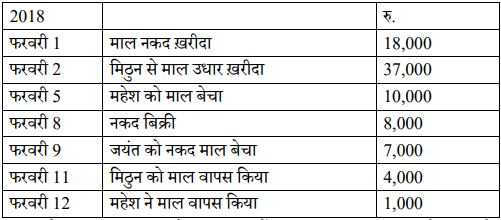

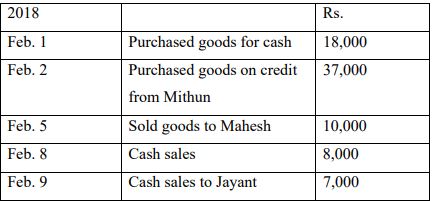

4. Journalise the following transactions:

5. Harinath purchased on January 1, 2016, a plant for Rs. 50,000. On July 1, 2016 an additional plant worth Rs. 20,000 was purchased and on July 1. 2017, the plant purchased on January 1, 2016 having become obsolete is sold off for Rs. 20,000. On July 1, 2018, a new plant was purchased for Rs. 60,000 and the plant purchased on July 1, 2016 was sold for Rs. 15,000. Depreciations to be provided at 10% p.a. on the written down value every year. Show the Plant Account.

SECTION-B

Attempt all the questions. Each question carries 5 marks.

6. Briefly describe the advantages and limitations of accounting.

7. What is an account? Describe the various classes of accounts with examples.

8. Write about the Business Entity Concept.

9. What do you mean by double entry system?

10. What is a Balance Sheet? Describe different methods of arranging assets and liabilities.

SECTION-C

Attempt all the questions. Each question carries 10 marks.

11. What is Trial Balance?

12. What are the characteristics of a hire purchase agreement?

13. “Consignment is the same thing as sale”. Briefly Discuss.

14. Briefly explain advantages of Computerized Accounting.

IGNOU BCOC-131 (July 2022 - June 2023) Assignment Questions

SECTION-A

Attempt all the questions. Each question carries 10 marks.

Q1. Define Computerized Accounting and distinguish between manual and computerized accounting system.

Q2. Journalise the following transactions:

2018 Rs.

June 1 Cash sale of Ashok 18,000

June 2 Bought goods from Vinod 10,000

June 2 Paid cartage on the goods bought 200

June 3 Old newspapers sold 100

June 4 Paid Municipal taxes by cheque 900

June 4 Paid for repairs to machinery 600

June 8 Received commission by cheque 1,700

Q3. From the following transactions of M/s. Joshi & Sons, prepare Cash Book.

2018 Rs.

Aug. 1 Cash in hand 4,270

Aug. 5 Purchased and old typewriter for 1,500

Aug. 7 Received cash from Singh & Co. Rs. 1,980 and allowed discount of 20

Aug. 10 Cash Sales 5,500

Aug. 12 Paid to Ram Narain Rs. 2,970 and he allowed a discount of 30

Aug. 14 Sold old newspapers for Rs. 60.

Aug. 16 Received from Prasad Rs. 985 in full settlement of his account for 1,000

Aug. 18 Purchased goods worth from Sanjeev Bros. at a trade

discount of 10% and paid cash. 2,000

Aug. 20 Sold goods worth for cash at a trade discount of 5%. 1,000

Aug. 24 Settled the account of Tiwari of by paying the necessary amount

after deducting a discount of 3%. 500

Aug. 30 Paid rent 500

Aug. 30 Deposited in the bank the cash in excess of 1,490

Q4. Easy Payment Ltd. Sells goods on hire purchase basis at a profit of 50% on cost, The following particulars are given for the year ending December 31, 2018. Prepare the Hire Purchase Trading Account.

Rs.

Hire purchase Stock (opening) 18,000

Instalments due, customers paying (opening) 10,000

Goods sold on hire purchase during the year (at hire purchase price) 1,74,000

Cash received from customers 1,20,000

Goods repossessed valued at (instalments due Rs. 6,000) 3,000

Hire Purchase Stock at the end 60,000

Instalments due (at the end), customers paying 16,000

Expenses 19,000

5. On January 1, 2018 Universal Sports, Delhi consigned 180 cases of sports goods costing Rs. 360 each to Gemini Sports, Mumbai. They paid Rs 360 for insurance and Rs. 1,800 for freight. Gemini Sports are entitled to a commission of 10% on gross sales. Gemini Sports received the consignment on January 15 and sent a 60 days bill for Rs 10,000 to Universal Sport. The Bill was discounted for Rs. 9,000.

On opening the cases, the Consignee found 10 cases of wrong description and returned them, paying return freight of Rs. 400. Gemini Sports sold 120 cases @ Rs 600 each for cash and 20 cases @ Rs. 700 each on credit. Gemini Sports spent Rs. 720 on clearing charges and Rs. 600 on carriage outwards. They incurred bad debts amounting to Rs 400. The accounts were settled on June 30, and the balance remitted by cheque. Show necessary ledger accounts in the books of both the parties.

SECTION-B

Attempt all the questions. Each question carries 5 marks.

Q6. Briefly discuss the functions of accounting.

Q7. Write about the Business Entity Concept.

Q8. What do you mean by double entry system?

Q9. What is a compound journal entry? Give examples.

Q10. What are the characteristics of a hire purchase agreement?

Q11. What are post-dated vouchers? Explain its use.

SECTION-C

Attempt all the questions. Each question carries 10 marks.

Q12. What are the qualitative characteristics of accounting information?

Q13. State the salient features of joint venture. Distinguish it from consignment.

Buy BCOC-131 Assignment IGNOU BCOC-131 (July 2023 - June 2024) Assignment Questions

खण्ड - क

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 10 अंक के हैं)

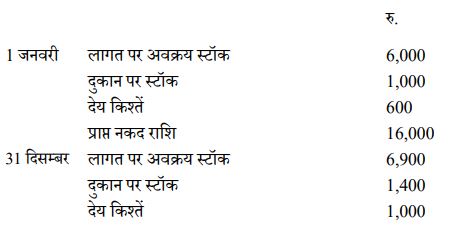

1. होम एप्लाएंसेज लि. अवक्रय मूल्य पर 25% लाभ पर अवक्रय पर माल बेचता है। 31 दिसम्बर 2018 को समाप्त होने वाले वर्ष में हुए लेन-देन के विवरण निम्नलिखित हैं।

देनदार प्रणाली के अंतर्गत अवक्रय पर होने वाले लाभ या हानि का परिकलन कीजिए ।

2. लेखाकरण की गुणात्मक विशेषताएं क्या है ? संक्षिप्त में विवेचना कीजिए ।

3. IFRS की संकल्पना की व्याख्या कीजिए ।

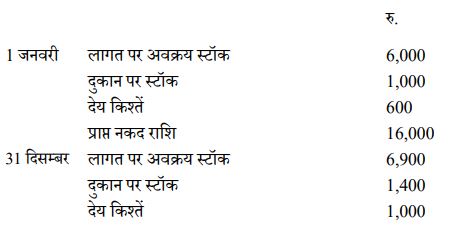

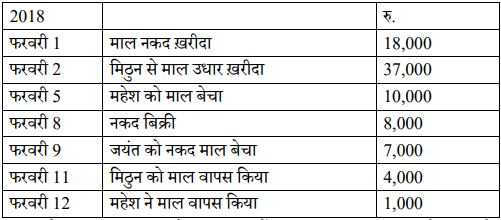

4. नीचे दिए गए लेन-देन रोजनामचे में दर्ज कीजिए ।

5. हरिनाथ ने 1 जनवरी, 2016 को 50,000 रु. में एक प्लांट ख़रीदा । 1 जुलाई 2016 को एक और प्लांट 20,000 रु. में ख़रीदा गया तथा 1 जनवरी 2016 को ख़रीदे गये प्लांट के अप्रचलित हो जाने के कारण उसे 1 जुलाई 2017 को 20,000 रु. में बेच दिया गया। 1 जुलाई 2018 को एक नया प्लांट 60,000 रु. में ख़रीदा गया तथा 1 जुलाई 2016 को ख़रीदे गए प्लांट को 15,000 रु. में बेच दिया गया । ह्रासित मूल्य (written down value) पर प्रतिवर्ष 10% की दर से मूल्यह्रास का प्रावधान करना है। प्लांट खाता दिखाइए।

खण्ड - ख

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 6 अंक के हैं)

6. खाकरण के लाभ एवं सीमाओं की संक्षिप्त में व्याख्या कीजिए ।

7. खाता क्या है । खातों के विभिन्न वर्गों का उदाहरण सहित वर्णन कीजिए।

8. रिकॉर्ड संबंधी संकल्पनाओं के बारे में लिखें।

9. दोहरा लेखा प्रणाली से आप क्या समझते हैं ?

10. बैलेंस शीट क्या है ? परिसंपत्तियों तथा देयताओं को व्यवस्थित करने की विभिन्न विधियों का वर्णन कीजिए ।

खण्ड - ग

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 5 अंक के हैं)

11. तलपट का क्या अर्थ है ?

12. अवक्रय करार की क्या विशेषताएँ हैं ?

13. "प्रेषण ठीक वैसा ही है जैसा कि विक्रय” संक्षिप्त में व्याख्या कीजिए ।

14. कंप्यूटरीकृत लेखांकन के लाभों का वर्णन संक्षिप्त में कीजिए ।

IGNOU BCOC-131 (July 2022 - June 2023) Assignment Questions

सभी प्रश्नों के उत्तर दीजिए ।

खण्ड क

1. कम्प्यूटरीकृत लेखांकन प्रणाली को परिभाषित करें । मेन्युअल और कम्प्यूटरीकृत लेखांकन प्रणाली में अंतर की विवेचना कीजिए ।

2. निम्नलिखित लेन-देन को रोजनामचे में दर्ज कीजिए ।

2018 रु.

जून 1 अशोक को नकद बिक्री 18,000

जून 2 विनोद से माल ख़रीदा 10,000

जून 2 इस माल पर ढुलाई (cartage) का भुगतान किया 200

जून 3 पुराने अखबारों की बिक्री से प्राप्त 100

जून 4 चेक द्वारा नगरपालिका करों (municipal taxes) का भुगतान किया 900

जून 4 मशीनरी की मरम्मत (तम चंपते) के लिए भुगतान किया 600

जून 8 चेक द्वारा कमीशन प्राप्त किया 1,700

3. जोशी एंड संस के निम्नलिखित लेन-देन से रोकड़ बही तैयार कीजिए ।

2018

अगस्त 1 रोकड़ शेष 4, 270 रुपये

अगस्त 5 पुराना टाइपराईटर ख़रीदा 1,500

अगस्त 7 सिंह एंड कंपनी से नकद मिले 1,980 रुपये तथा 20 रुपये की छूट दी ।

अगस्त 10 नकद विक्रय 5,500 रुपये

अगस्त 12 राम नारायण को भुगतान किया 2, 970 रुपये और उन्होंने 30 रुपये की छूट दी।

अगस्त 14 60 रुपये के पुराने अखबार बेचे

अगस्त 16 प्रसाद से 1,000 रुपये लेने थे, उसने 985 रुपये देकर हिसाब चुकता किया ।

अगस्त 18 संजीव ब्रादर्स से 10% के व्यापारिक छूट पर 2,000 रुपये का माल खरीदा और नकद भुगतान दिया

अगस्त 20 1,000 रुपये के माल को 5% व्यापारिक छूट पर नकद बेचा।

अगस्त 24 3% छूट लेकर तिवारी का 500 रुपये का हिसाब चुकता किया।

अगस्त 30 500 रुपये किराये के दिए ।

अगस्त 30 1,490 रुपये से अधिक रोकड़ को बैंक में जमा किया।

4. ईजी पेमेंट्स लि. लागत पर 50% लाभ पर अवक्रय के आधार पर माल बेचता है । 31 दिसम्बर 2018 को समाप्त होने वाले वर्ष के लिए निम्नलिखित विवरण दिए गए हैं।

रु.

अवक्रय स्टॉक खाता (प्रारंभिक) 18,000

देय किश्तें, जो ग्राहक भुगतान कर रहे हैं (प्रारंभिक) 10,000

वर्ष के दौरान अवक्रय पर बेचा गया माल (अवक्रय मूल्य पर) 1,74,000

ग्राहकों से प्राप्त नकद राशि 1,20,000

पुनर्ग्रहण किये गए माल का मूल्य (देय किश्तें 6,000 रु. ) 3,000

अंत में अवक्रय स्टॉक खाता 60,000

देय किश्तें (अंत में ), जो ग्राहक भुगतान कर रहे हैं। 16,000

व्यय 19,000

5. दिल्ली के गुरशरण एंड कंपनी ने 1 जनवरी, 2018 को कलकत्ता के सिंह एंड कं. को 40,000 रु. की लागत की 50 पेटियां ग्लासवेयर विक्रय के लिए प्रेषण पर भेजी। इसकी सकल बिक्री - प्राप्तियों पर 5% की दर से कमीशन मिलना था । गुरशरण एंड कं. ने मालभाड़ा और ढुलाई पर 500 रु. और पैकिंग पर 600 रु. का भुगतान दिया ।

सिंह एंड कं. ने 5 जनवरी 2018 को माल प्राप्त किया तथा निकासी व्यय के लिए 300 रु. माल भाडा के लिए 200 रु., विविध व्ययों के लिए 50 रु. तथा गोदाम के किराय के लिए 100 रु. का भुगतान किया। उन्होंने 1,000 रु. प्रति पेटी की दर से 15 पेटियां, 1,200 रु. प्रति पेटी की दर से 25 पेटियां, तथा 1,100 रु. प्रति पेटी की दर से 10 पेटियां बेचीं ।

5 अप्रैल 2018 को सिंह एंड कं. ने गुरशरण एंड कं. को उनके हिसाब में 15,000 रु. का बैंक ड्राफ्ट भेजा। 10 अप्रैल 2018 को सिंह कं. ने एक विक्रय विवरण भेजा जिसके साथ शेष देय राशि के लिए एक बिल भी था ।

दोनों पक्षों की लेखा पुस्तकों में आवश्यक लेजर खाते बनाइए ।

खण्ड - ख

6. लेखाकरण के कार्यों का संक्षेप में वर्णन कीजिए ।

7.व्यवसायिक एका की संकल्पना के बारे में बताइए ।

8. दोहरा लेखा प्रणाली से आप क्या समझते हैं ?

9. संयुक्त रोजनामचे प्रविष्टि (Compound Journal Entry) किसे कहते हैं? उदाहरण देकर स्पष्ट कीजिए ।

10. अवक्रय करार की क्या विशेषताएं हैं ?

11. पोस्ट - डेटेड वाऊचर क्या है ? इसके उपयोग बताइये ।

खण्ड - ग

12. लेखाकरण की गुणात्मक विशेषताएं क्या है ? इसकी विवेचना कीजिए ।

13. संयुक्त उपक्रम के मुख्य लक्षण बताइए। इसका प्रेषण से अंतर बताइए।

Buy BCOC-131 Assignment

Calculate the profit or loss on hire purchase under Debtors Method.

2. What are the qualitative characteristics of accounting information? Briefly explain.

3. Explain the Concept of IFRS.

4. Journalise the following transactions:

Calculate the profit or loss on hire purchase under Debtors Method.

2. What are the qualitative characteristics of accounting information? Briefly explain.

3. Explain the Concept of IFRS.

4. Journalise the following transactions:

5. Harinath purchased on January 1, 2016, a plant for Rs. 50,000. On July 1, 2016 an additional plant worth Rs. 20,000 was purchased and on July 1. 2017, the plant purchased on January 1, 2016 having become obsolete is sold off for Rs. 20,000. On July 1, 2018, a new plant was purchased for Rs. 60,000 and the plant purchased on July 1, 2016 was sold for Rs. 15,000. Depreciations to be provided at 10% p.a. on the written down value every year. Show the Plant Account.

SECTION-B

Attempt all the questions. Each question carries 5 marks.

6. Briefly describe the advantages and limitations of accounting.

7. What is an account? Describe the various classes of accounts with examples.

8. Write about the Business Entity Concept.

9. What do you mean by double entry system?

10. What is a Balance Sheet? Describe different methods of arranging assets and liabilities.

SECTION-C

Attempt all the questions. Each question carries 10 marks.

11. What is Trial Balance?

12. What are the characteristics of a hire purchase agreement?

13. “Consignment is the same thing as sale”. Briefly Discuss.

14. Briefly explain advantages of Computerized Accounting.

5. Harinath purchased on January 1, 2016, a plant for Rs. 50,000. On July 1, 2016 an additional plant worth Rs. 20,000 was purchased and on July 1. 2017, the plant purchased on January 1, 2016 having become obsolete is sold off for Rs. 20,000. On July 1, 2018, a new plant was purchased for Rs. 60,000 and the plant purchased on July 1, 2016 was sold for Rs. 15,000. Depreciations to be provided at 10% p.a. on the written down value every year. Show the Plant Account.

SECTION-B

Attempt all the questions. Each question carries 5 marks.

6. Briefly describe the advantages and limitations of accounting.

7. What is an account? Describe the various classes of accounts with examples.

8. Write about the Business Entity Concept.

9. What do you mean by double entry system?

10. What is a Balance Sheet? Describe different methods of arranging assets and liabilities.

SECTION-C

Attempt all the questions. Each question carries 10 marks.

11. What is Trial Balance?

12. What are the characteristics of a hire purchase agreement?

13. “Consignment is the same thing as sale”. Briefly Discuss.

14. Briefly explain advantages of Computerized Accounting. देनदार प्रणाली के अंतर्गत अवक्रय पर होने वाले लाभ या हानि का परिकलन कीजिए ।

2. लेखाकरण की गुणात्मक विशेषताएं क्या है ? संक्षिप्त में विवेचना कीजिए ।

3. IFRS की संकल्पना की व्याख्या कीजिए ।

4. नीचे दिए गए लेन-देन रोजनामचे में दर्ज कीजिए ।

देनदार प्रणाली के अंतर्गत अवक्रय पर होने वाले लाभ या हानि का परिकलन कीजिए ।

2. लेखाकरण की गुणात्मक विशेषताएं क्या है ? संक्षिप्त में विवेचना कीजिए ।

3. IFRS की संकल्पना की व्याख्या कीजिए ।

4. नीचे दिए गए लेन-देन रोजनामचे में दर्ज कीजिए ।

5. हरिनाथ ने 1 जनवरी, 2016 को 50,000 रु. में एक प्लांट ख़रीदा । 1 जुलाई 2016 को एक और प्लांट 20,000 रु. में ख़रीदा गया तथा 1 जनवरी 2016 को ख़रीदे गये प्लांट के अप्रचलित हो जाने के कारण उसे 1 जुलाई 2017 को 20,000 रु. में बेच दिया गया। 1 जुलाई 2018 को एक नया प्लांट 60,000 रु. में ख़रीदा गया तथा 1 जुलाई 2016 को ख़रीदे गए प्लांट को 15,000 रु. में बेच दिया गया । ह्रासित मूल्य (written down value) पर प्रतिवर्ष 10% की दर से मूल्यह्रास का प्रावधान करना है। प्लांट खाता दिखाइए।

खण्ड - ख

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 6 अंक के हैं)

6. खाकरण के लाभ एवं सीमाओं की संक्षिप्त में व्याख्या कीजिए ।

7. खाता क्या है । खातों के विभिन्न वर्गों का उदाहरण सहित वर्णन कीजिए।

8. रिकॉर्ड संबंधी संकल्पनाओं के बारे में लिखें।

9. दोहरा लेखा प्रणाली से आप क्या समझते हैं ?

10. बैलेंस शीट क्या है ? परिसंपत्तियों तथा देयताओं को व्यवस्थित करने की विभिन्न विधियों का वर्णन कीजिए ।

खण्ड - ग

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 5 अंक के हैं)

11. तलपट का क्या अर्थ है ?

12. अवक्रय करार की क्या विशेषताएँ हैं ?

13. "प्रेषण ठीक वैसा ही है जैसा कि विक्रय” संक्षिप्त में व्याख्या कीजिए ।

14. कंप्यूटरीकृत लेखांकन के लाभों का वर्णन संक्षिप्त में कीजिए ।

5. हरिनाथ ने 1 जनवरी, 2016 को 50,000 रु. में एक प्लांट ख़रीदा । 1 जुलाई 2016 को एक और प्लांट 20,000 रु. में ख़रीदा गया तथा 1 जनवरी 2016 को ख़रीदे गये प्लांट के अप्रचलित हो जाने के कारण उसे 1 जुलाई 2017 को 20,000 रु. में बेच दिया गया। 1 जुलाई 2018 को एक नया प्लांट 60,000 रु. में ख़रीदा गया तथा 1 जुलाई 2016 को ख़रीदे गए प्लांट को 15,000 रु. में बेच दिया गया । ह्रासित मूल्य (written down value) पर प्रतिवर्ष 10% की दर से मूल्यह्रास का प्रावधान करना है। प्लांट खाता दिखाइए।

खण्ड - ख

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 6 अंक के हैं)

6. खाकरण के लाभ एवं सीमाओं की संक्षिप्त में व्याख्या कीजिए ।

7. खाता क्या है । खातों के विभिन्न वर्गों का उदाहरण सहित वर्णन कीजिए।

8. रिकॉर्ड संबंधी संकल्पनाओं के बारे में लिखें।

9. दोहरा लेखा प्रणाली से आप क्या समझते हैं ?

10. बैलेंस शीट क्या है ? परिसंपत्तियों तथा देयताओं को व्यवस्थित करने की विभिन्न विधियों का वर्णन कीजिए ।

खण्ड - ग

(सभी प्रश्न अनिवार्य हैं। प्रत्येक प्रश्न 5 अंक के हैं)

11. तलपट का क्या अर्थ है ?

12. अवक्रय करार की क्या विशेषताएँ हैं ?

13. "प्रेषण ठीक वैसा ही है जैसा कि विक्रय” संक्षिप्त में व्याख्या कीजिए ।

14. कंप्यूटरीकृत लेखांकन के लाभों का वर्णन संक्षिप्त में कीजिए ।